#

NAYM Token Overview

#

Introduction

The NAYM token is designed to fund the Nayms Liquidity Fund (NLF), which takes positions in Nayms Platform Participation Tokens (P-Tokens) used for underwriting insurance policies. NAYM token holders can stake their tokens to earn NLF profit distributions as rewards. The reward weight of the staker gets boosted over time as the duration of the stake increases, based on a specific mathematical formula.

#

Additional References

More detailed information on the NAYM token can be viewed in the Nayms Token Paper

The NAYM Token itself is a basic ERC-20, and has no special attributes.

The staking mechanism of the NAYM token is implemented in the Nayms platform, and can theoretically work for any imported ERC20 token. Nayms Platform

#

Nayms Liquidity Fund (NLF)

The NLF is an Entity on the Nayms Platform that selectively buys and sells P-Tokens on behalf of the NAYM token holders. It earns distributions from the p-tokens it holds and also generates trading profits and reward distributions. Control of the NLF p-token positions is delegated to professional vendors selected through governance.

#

Participation Tokens (P-Tokens)

P-Tokens are created and sold to underwrite insurance portfolios. These tokens earn their share of the premiums via a simple distribution mechanism.

#

NAYM Governance

Staked token holders will participate in governance with a weight equal to the number of tokens staked.

Governance decisions will pertain to the following areas:

- NAYM Token supply

- NLF NAYM Token offering

- NLF fund manager selection

- NLF fund manager allocations

#

Staking and Rewards

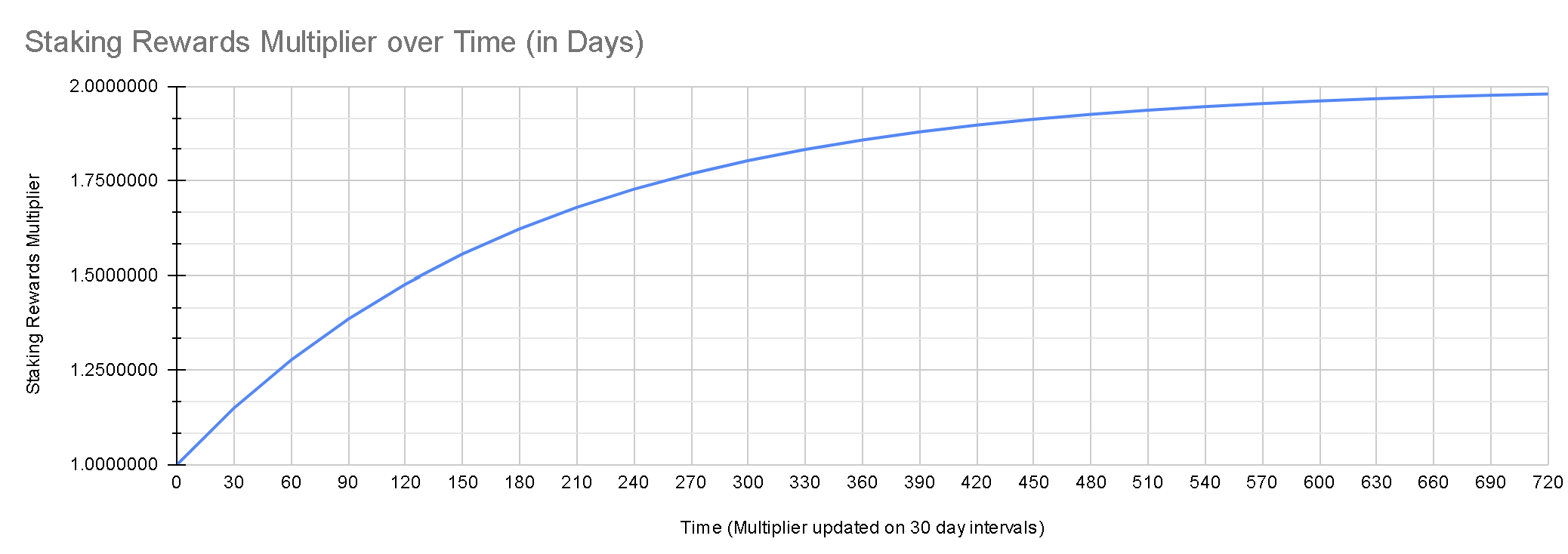

NAYM token holders have the opportunity to stake their tokens in order to earn rewards. These rewards are a function of both the amount of NAYM tokens staked and the duration for which they are staked. The wight of the staked NAYM increases parabolically over time, and can approach a theoretical maximum of 2x the original staked amount. The graph below shows how the staking weight gets boosted over several intervals.

More details on parabolically weighted staking distributions can be found in the next section.

#

NAYM Sales through the NLF (Future)

In order for the NLF to raise capital, it will have the ability to sell NAYM on the platform. This will involve a price discovery mechanism. NAYM will be provided through the NLF at a markup and provide staked NAYM that is already boosted with the boost that would have accumulated over a predetermined number of intervals, currently set to 6. It is essential for the NLF to be capitalized in order to ensure rewards. The markup, as well as the boost bonus will be determined by governance.